Renewal Resources

A message from your 2024 GHAR President, Tracy Klinger.

ANSWERING YOUR MEMBERSHIP RENEWAL QUESTIONS

On behalf of GHAR, I would like to express my gratitude for your continued membership and support. Your involvement is essential to our success and allows us to offer valuable resources through the Greater Harrisburg Association of REALTORS®, Pennsylvania Association of REALTORS®, and National Association of REALTORS®.

I encourage you to explore this resource page to discover the valuable benefits of your membership across all three associations. The FAQ section below addresses the most common questions GHAR staff receive regarding dues payments.

Thank you for your dedication to our real estate profession. We look forward to a successful and impactful year ahead.

Sincerely,

Tracy Klinger, 2024 GHAR President

WHAT BENEFITS DO I RECEIVE FOR MY MEMBERSHIP?

As a Primary REALTOR® of the Greater Harrisburg Association of REALTORS® (GHAR), you enjoy a full range of benefits from all three associations: GHAR, the Pennsylvania Association of REALTORS® (PAR), and the National Association of REALTORS® (NAR). When you renew your 2025 membership, you are paying dues for all 3 levels of the REALTOR® association.

If you are a Secondary Member, your benefits will be specific to GHAR, and potentially also include PAR, depending on your selection.

Greater Harrisburg Association of REALTORS® Top Benefits

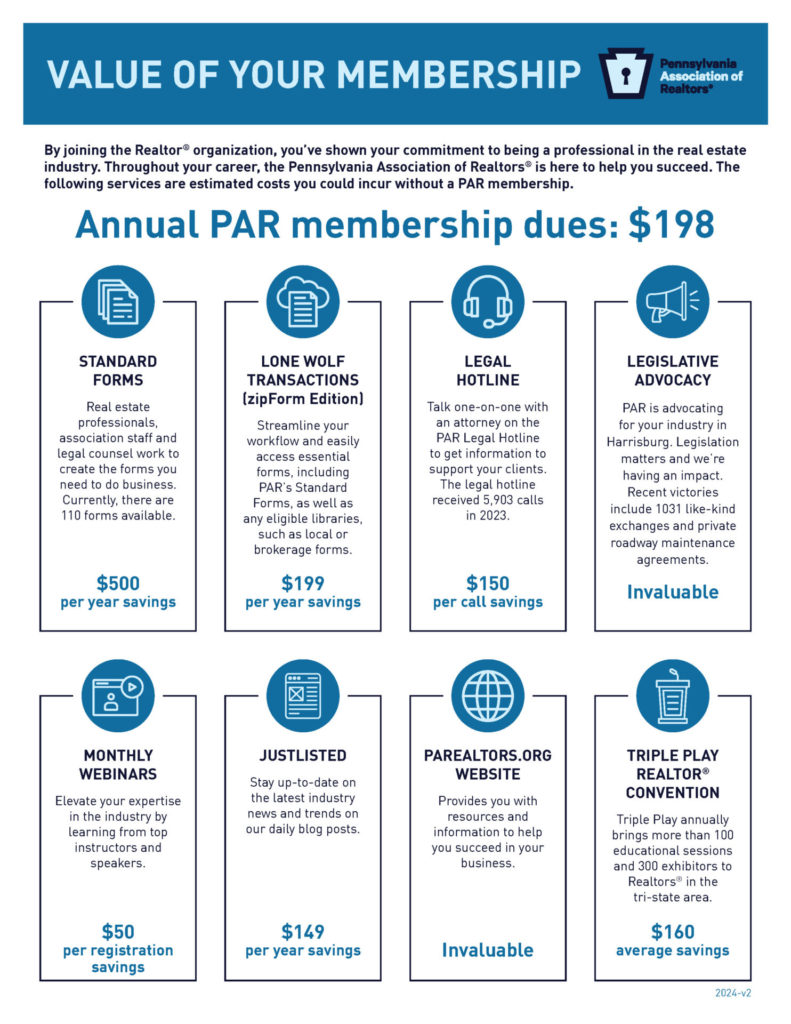

Pennsylvania Association of REALTORS® Top Benefits

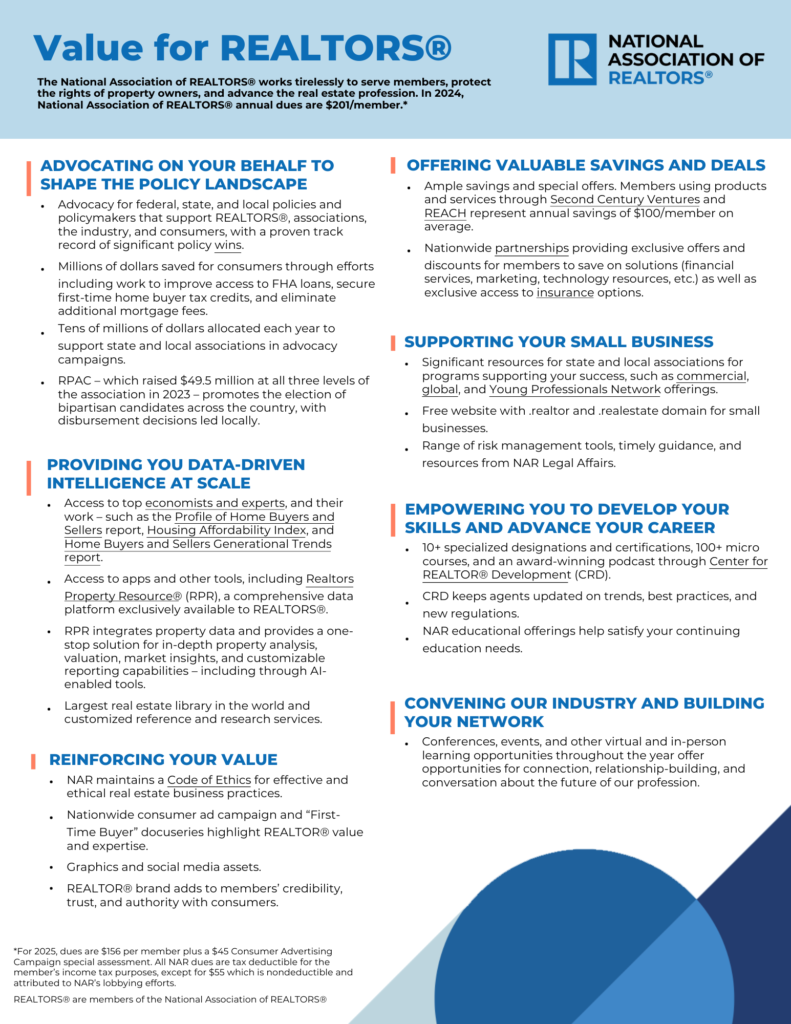

National Association of REALTORS® Top Benefits

2025 MEMBERSHIP RENEWAL FAQ

How are GHAR Members notified of their annual membership renewal?

Members are emailed a notice that their annual membership renewal invoice for GHAR, PAR, and NAR is available in their portal.

Reminders are sent via email, included in the GHAR weekly e-newsletter and brokers are notified.

How do I pay my 2025 membership dues?

Members are able to renew through the portal.

Payments can also be made by calling 717-364-3200 or by mail: PO Box 244, Elizabeth Town, PA 17022-0244

What is the cost to renew my membership?

Below is the breakdown of 2025 membership renewal.

| Greater Harrisburg Association of REALTORS® (Local) | $175 |

| Pennsylvania Association of REALTORS® (State) | $198 |

| National Association of REALTORS® (National) | $156 |

| Consumer Advertising Campaign | $45 |

| Total Dues | $574 |

| Voluntary RPAC contribution | $49.50 |

What should my invoice look like?

Your invoice reflects the $574 renewal fee and the $49.50 voluntary RPAC contribution.

We apologize for the confusion between the amount in the email (which included the voluntary RPAC amount) and the invoice amount. Some of the message was auto generated and we apologize the message was not vetted properly by GHAR staff.

The investment in RPAC is voluntary. The GHAR Trustees agreed to the $49.50 amount years ago. When paying dues, there is an option to modify the RPAC amount. You may decrease the amount, increase the amount, or totally delete the investment.

Am I required to make the $49.50 RPAC investment?

No, the $49.50 RPAC contribution is voluntary.

The goal of RPAC is to establish the real estate industry as a concerned and involved constituency that gives active support to political candidates who recognize the needs of REALTORS® and property owners. RPAC is bi-partisan in its selection of candidates. Click here to learn more about RPAC.

If you choose to contribute a different amount or elect not to contribute to RPAC at this time, click on the “Modify” button before clicking “process” when paying online. Click here to view a how to.

How do I modify my voluntary RPAC contribution amount?

Your invoice will show a voluntary RPAC contribution amount of $49.50. You are able to modify that payment within your Member portal. Please use this video as a guide.

I have education credits on file, can I just use those to pay for my renewal?

No, you are not able to apply education credits to your renewal invoice.

When must I pay my annual membership dues?

All renewal payments must be paid in full by January 10, 2025.

What happens if I don’t renew my membership before the deadline?

If a member does not renew their membership by the January 10, 2025 deadline there will be a $200 late fee that will be assessed on January 13, 2025.

If the full payment and late fee are not paid by January 21, 2025 then the broker will be notified and billed for the outstanding payment.

Can I set up a payment plan for my renewal?

Members can make individual membership renewal payments through the member portal.

But please note! Full payment MUST BE paid by January 10, 2025 to avoid the $200 late fee.

Are membership renewal dues refundable?

No, membership renewal dues payments are non-refundable.

Am I able to make a partial payment for my renewal?

Yes, you are able to make partial payment installments through your member portal.

But please note! If the full payment MUST BE paid by January 10, 2025 in order to avoid the $200 late fee.

I have questions regarding the Pennsylvania Association of REALTORS® membership. Who can I talk to?

For questions regarding PAR membership, please call 800-555-3390.

Does PAR have a benefits resource page?

Yes, PAR does have a benefits resource page, click here

How much was the portion of the PAR dues increased?

The Pennsylvania Association of Realtors® Board of Directors approved the 2025 budget, which includes a $48 dues increase, bringing PAR dues to $198.

When was the last time PAR raised dues?

The last dues increase was approved by the Board of Directors in 2016 and went into effect in 2018.

Does the PAR dues increase reflect the rate of inflation over the past six years?

The Finance Committee reviewed the rate of inflation and the Consumer Price Index and the increase is in line with those financial standards.

I can’t remember if I paid my renewal dues, how can I check?

Members can sign into their GHAR Member Portal to view billing information. On the right hand side, select Menu followed by Financial Services. Then select ‘Check your Account- Association.’

Members can also call the association to verify payment status.

What should I do if I don’t remember my GHAR Portal login?

If you remember your ‘Username’ but can’t remember your password, you can select ‘Forgot Password’ to reset it.

If you do not remember your ‘Username’, please email Chris@ghar.realtor or call (717) -364-3200.

When was the last time GHAR raised the fee for membership renewal?

The last time GHAR raised the membership renewal fee was 2023.

What are the requirements for maintaining a REALTOR® membership?

Licensure – A member must continue to maintain an active Real Estate license in Pennsylvania or a state contiguous thereto. If your license becomes inactive, escrowed, or placed with a referral company, your membership is required to be cancelled.

Affiliation – A member must affiliate their license with a Designated REALTOR® of an office that belongs to the Greater Harrisburg Association of REALTORS® (GHAR). If the Designated REALTOR® does not belong to GHAR, either he/she has to opt to join the organization or the member must consider joining the local organization to which the Designated REALTOR® already belongs.

Dues – A member must remit the annual membership payment to GHAR for their local, state and national dues. If a member fails to remit payment and is still actively licensed in a primary REALTOR® office, then the Association is required to bill the broker/manager for the licensee as a non-member.

Education – A member must complete the National Association of REALTORS® Code of Ethics requirement every three years (current deadline is December 31, 2024).

2025 MEMBERSHIP RENEWAL

Timeline

| October 16 | Renewal invoices are emailed |

| January 10 | Renewal payment is due |

| January 13 | $200 reinstatement fee for late dues invoiced |

| January 21 | Broker is billed for unpaid renewal |

| February 10 | Membership suspended for non-payment |

Breakdown of 2025 Renewal

| Greater Harrisburg Association of REALTORS® (Local) | $175 |

| Pennsylvania Association of REALTORS® (State) | $198 |

| National Association of REALTORS® (National) | $156 |

| Consumer Advertising Campaign | $45 |

| Total Dues | $574 |

| Voluntary RPAC contribution | $49.50 |

DISCLAIMER: *RPAC contributions are not deductible for income tax purposes. Contributions to RPAC are voluntary and are used for political purposes. The amount suggested is merely a guideline and you may contribute more or less than the suggested amount. You may refuse to contribute without reprisal and NAR or any of its state associations or local boards will not favor or disfavor any member because of the amount contributed. Seventy percent (70%) of each contribution is used by your state PAC to support state and local political candidates. Until your state PAC reaches its RPAC goal, thirty percent (30%) is sent to National RPAC to support federal candidates and is charged against your limits under 52 U.S.C.§ 30116; after the state PAC reaches its RPAC goal it may elect to retain your entire contribution for use in supporting state and local candidates.

TAX INFORMATION: The state portion of dues is $198 per member. PAR computes 5 percent or $10.00 to be nondeductible for the member’s income tax purposes due to PAR lobbying efforts. The national portion of dues is $150. NAR computes 34 percent or $55.00 to be nondeductible for the member’s income tax purposes due to NAR lobbying efforts. The entire $45.00 Consumer Advertising Campaign (CAC) qualifies as fully deductible. Membership dues is not tax deductible as charitable contributions; however, they may be tax deductible under other provisions of the Internal Revenue Code. Please seek advice from your tax professional.