Renewal Resources

A message from your 2025 GHAR President regarding Membership Renewal.

WHAT BENEFITS DO I RECEIVE FOR MY MEMBERSHIP?

As a Primary REALTOR® of the Greater Harrisburg Association of REALTORS® (GHAR), you enjoy a full range of benefits from all three associations: GHAR, the Pennsylvania Association of REALTORS® (PAR), and the National Association of REALTORS® (NAR). When you renew your 2026 membership, you are paying dues for all three levels of the REALTOR® association.

If you are a Secondary Member, your benefits will be specific to GHAR, and potentially also include PAR, depending on your selection.

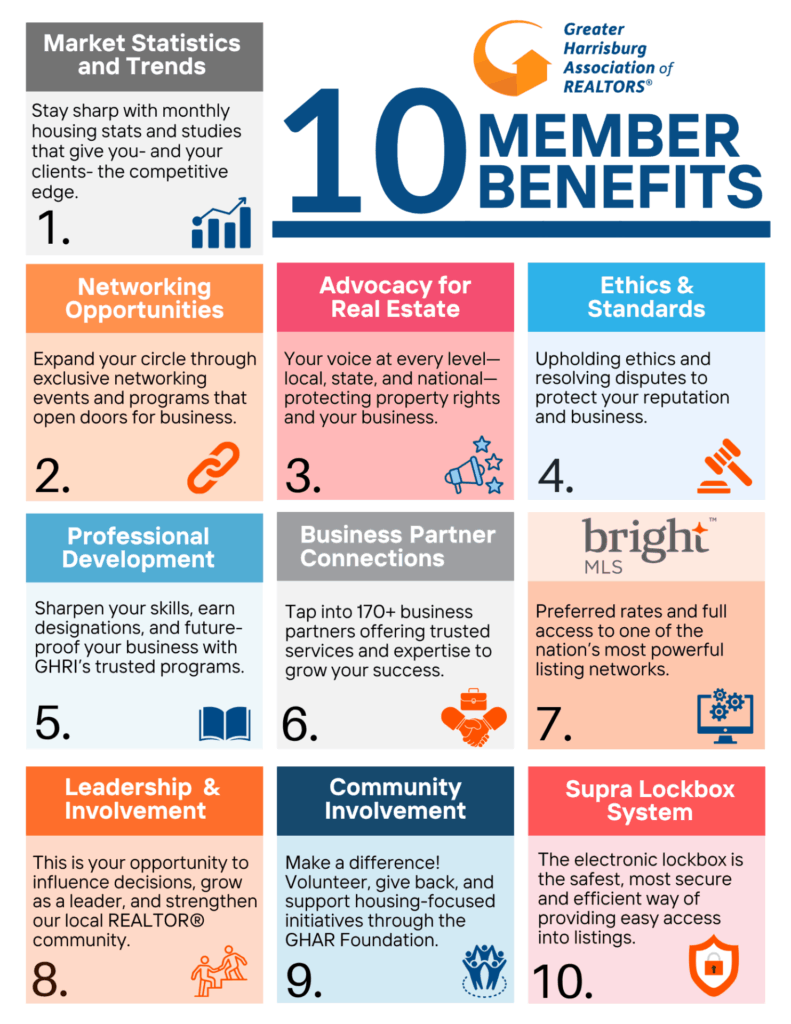

Greater Harrisburg Association of REALTORS® Top Benefits

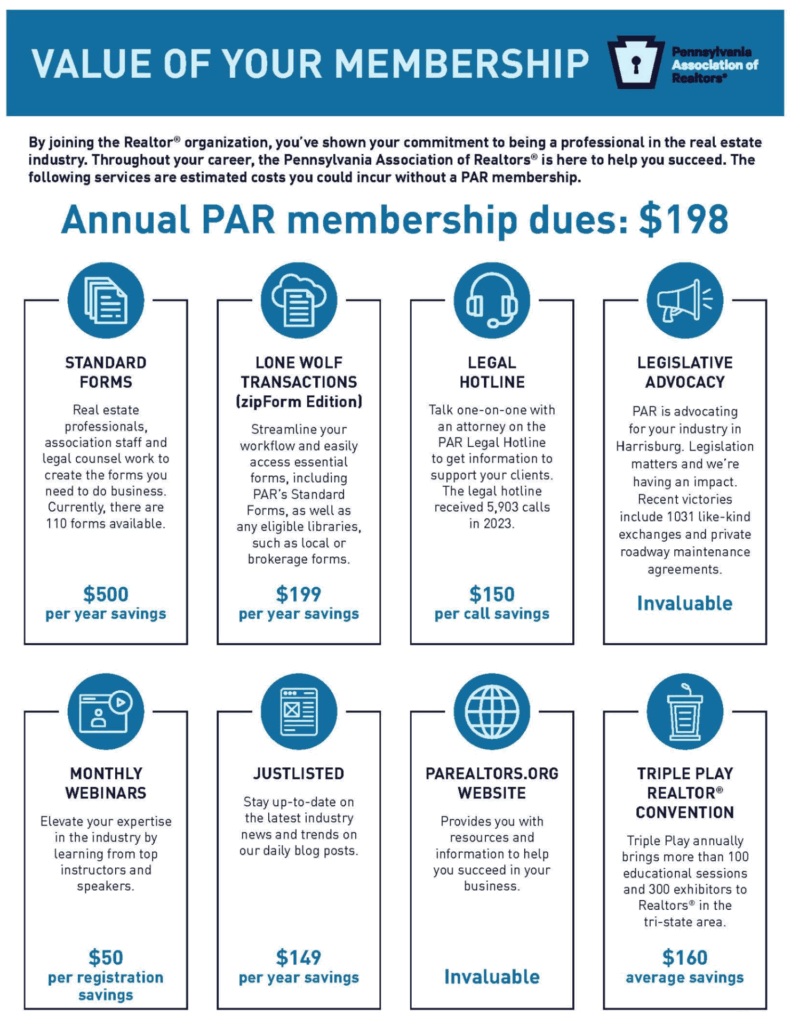

Pennsylvania Association of REALTORS® Top Benefits

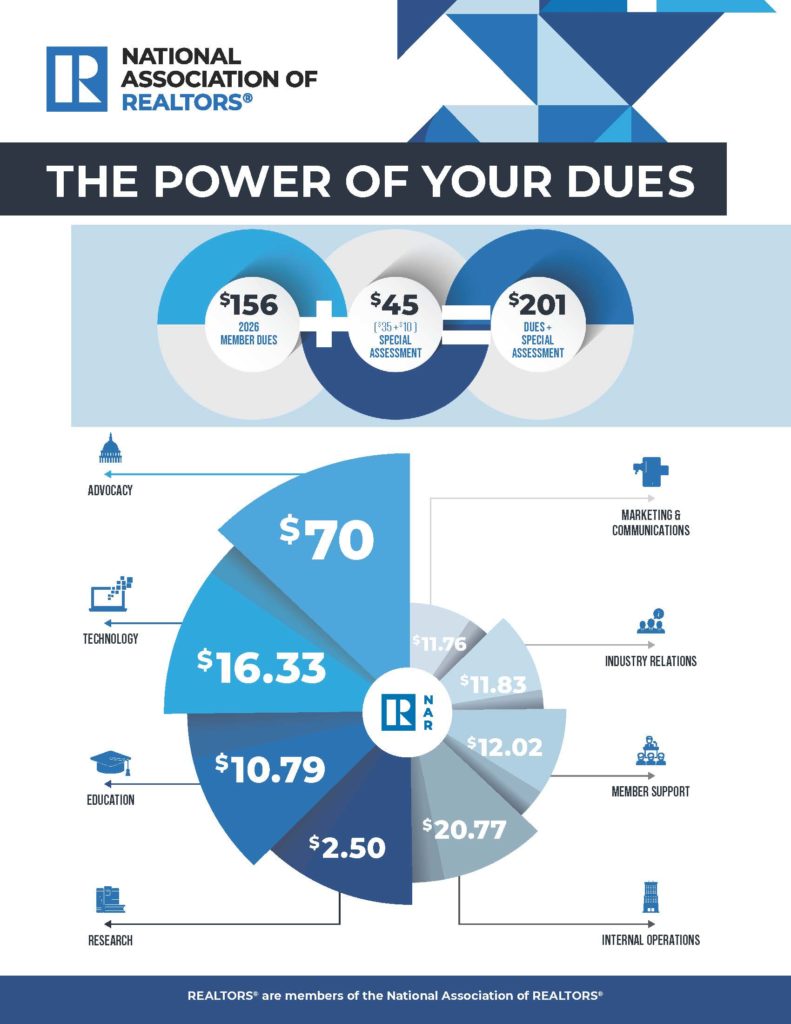

National Association of REALTORS® Top Benefits

2026 MEMBERSHIP RENEWAL FAQ

How are GHAR Members notified of their annual membership renewal?

Members are emailed a notice that their annual membership renewal invoice for GHAR, PAR, and NAR is available in their portal.

Reminders are sent via email, included in the GHAR weekly e-newsletter and brokers are notified.

How do I pay my 2026 membership dues?

Members are able to renew through the portal.

Payments can also be made by calling 717-364-3200 or by mail: PO Box 244, Elizabethtown, PA 17022-0244

What is the cost to renew my membership?

Below is the breakdown of 2025 membership renewal.

| Greater Harrisburg Association of REALTORS® (Local) | $175 |

| Pennsylvania Association of REALTORS® (State) | $198 |

| National Association of REALTORS® (National) | $156 |

| Consumer Advertising Campaign | $45 |

| Total Dues | $574 |

| Voluntary RPAC contribution | $49.50 |

What should my invoice look like?

Your invoice reflects the $574 renewal fee and the $49.50 voluntary RPAC contribution.

The investment in RPAC is voluntary. The GHAR Trustees agreed to the $49.50 amount years ago. When paying dues, there is an option to modify the RPAC amount. You may decrease the amount, increase the amount, or totally delete the investment.

Am I required to make the $49.50 RPAC investment?

No, the $49.50 RPAC contribution is voluntary.

The goal of RPAC is to establish the real estate industry as a concerned and involved constituency that gives active support to political candidates who recognize the needs of REALTORS® and property owners. RPAC is bi-partisan in its selection of candidates. Click here to learn more about RPAC.

If you choose to contribute a different amount or elect not to contribute to RPAC at this time, click on the “Modify” button before clicking “process” when paying online. Click here to view a how to.

How do I modify my voluntary RPAC contribution amount?

Your invoice will show a voluntary RPAC contribution amount of $49.50. You are able to modify that payment within your Member portal. Please use this video as a guide.

I have education credits on file, can I just use those to pay for my renewal?

No, you are not able to apply education credits to your renewal invoice.

When must I pay my annual membership dues?

All renewal payments must be paid in full by January 9, 2026.

What happens if I don’t renew my membership before the deadline?

If a member does not renew their membership by the January 9, 2026, deadline, a $75 reinstatement fee will be assessed on January 12, 2026.

If the full payment and reinstatement fee are not paid by January 25, 2026, an additional $100 reinstatement fee will be added to your account.

Can I set up a payment plan for my renewal?

Members can make individual membership renewal payments through the member portal.

But please note! Full payment MUST BE paid by January 9, 2026, to avoid the $75 late fee. If the full payment and reinstatement fee are not paid by January 25, 2026, an additional $100 reinstatement fee will be added to your account.

Are membership renewal dues refundable?

No, membership renewal dues payments are non-refundable.

Am I able to make a partial payment for my renewal?

Yes, you are able to make partial payment installments through your member portal.

But please note! If the full payment MUST BE paid by January 12, 2026, in order to avoid the $75 late fee. If the late fee and full payment are not made by January 26, 2026, an additional $100 late fee will be added to your account.

I have a credit card on file with GHAR. Was I automatically charged?

No, GHAR does NOT automatically charge your credit card if it’s on file. You will need to accept the charge manually in the Member ID portal.

I have questions regarding the Pennsylvania Association of REALTORS® membership. Who can I talk to?

For questions regarding PAR membership, please call 800-555-3390.

Does PAR have a benefits resource page?

Yes, PAR does have a benefits resource page, click here

I can’t remember if I paid my renewal dues, how can I check?

Members can sign into their GHAR Member Portal to view billing information. On the right hand side, select Menu followed by Financial Services. Then select ‘Check your Account- Association.’

Members can also call the association to verify payment status.

What should I do if I don’t remember my GHAR Portal login?

If you remember your ‘Username’ but can’t remember your password, you can select ‘Forgot Password’ to reset it.

If you do not remember your ‘Username’, please email Chris@ghar.realtor or call (717) -364-3200.

When was the last time GHAR raised the fee for membership renewal?

The last time GHAR raised the membership renewal fee was 2023.

What are the requirements for maintaining a REALTOR® membership?

Licensure – A member must continue to maintain an active Real Estate license in Pennsylvania or a state contiguous thereto. If your license becomes inactive, escrowed, or placed with a referral company, your membership is required to be cancelled.

Affiliation – A member must affiliate their license with a Designated REALTOR® of an office that belongs to the Greater Harrisburg Association of REALTORS® (GHAR). If the Designated REALTOR® does not belong to GHAR, either he/she has to opt to join the organization or the member must consider joining the local organization to which the Designated REALTOR® already belongs.

Dues – A member must remit the annual membership payment to GHAR for their local, state and national dues. If a member fails to remit payment and is still actively licensed in a primary REALTOR® office, then the Association is required to bill the broker/manager for the licensee as a non-member.

Education – A member must complete the National Association of REALTORS® Code of Ethics requirement every three years (current deadline is December 31, 2026).

2026 MEMBERSHIP RENEWAL

Timeline

| October 15 | Renewal invoices are emailed |

| January 9 | Renewal payment is due |

| January 12 | $75 reinstatement fee for late dues invoiced |

| January 26 | Additional $100 reinstatement fee added |

| February 2 | Broker is billed for unpaid renewal |

| February 9 | Membership suspended for non-payment |

Breakdown of 2026 Renewal

| Greater Harrisburg Association of REALTORS® (Local) | $175 |

| Pennsylvania Association of REALTORS® (State) | $198 |

| National Association of REALTORS® (National) | $156 |

| Consumer Advertising Campaign | $45 |

| Total Dues | $574 |

| Voluntary RPAC contribution | $49.50 |

Disclaimer: Contributions are not deductible for income tax purposes. Contributions to RPAC are voluntary and are used for political purposes. The amount suggested is merely a guideline and you may contribute more or less than the suggested amount. You may refuse to contribute without reprisal and the National Association of REALTORS® or any of its state associations or local boards will not favor or disfavor any member because of the amount contributed. 70% of each contribution is used by PA RPAC to support state and local political candidates. Until PA RPAC reaches its RPAC goal 30% is sent to National RPAC to support federal candidates and is charged against your limits under 52 U.S.C § 30116; after PA RPAC reaches its RPAC goal it may elect to retain your entire contribution for use in supporting state and local candidates. Under federal law only personal contributions (checks not drawn from corporate accounts) contribution up to $999 will be directed to the PA RPAC administrative fund, which utilizes the funds to engage in other political activities. 30% of corporate investments $1,000 or more will be directed to NAR’s Political Advocacy Fund, which utilizes the funds to engage in other federal political activities, and the state RPAC Administrative fund will retain 70%.

TAX INFORMATION: The state portion of dues is $198 per member. PAR computes 5 percent or $10.00 to be nondeductible for the member’s income tax purposes due to PAR lobbying efforts. The national portion of dues is $150. NAR computes 34 percent or $55.00 to be nondeductible for the member’s income tax purposes due to NAR lobbying efforts. The entire $45.00 Consumer Advertising Campaign (CAC) qualifies as fully deductible. Membership dues is not tax deductible as charitable contributions; however, they may be tax deductible under other provisions of the Internal Revenue Code. Please seek advice from your tax professional.